Is running your own Payroll becoming a burden?

We specialise in UK Payroll Services, processing Payrolls for small and medium size businesses. In these days of rapidly changing payroll legislation it is difficult to keep pace with latest developments. Businesses are subject to regular PAYE inspections and the consequences of mistakes in the payroll can be very expensive and time consuming.

With the addition of Auto Enrolment and keeping The Pensions Regulator happy, managing the workforce can be a real admin burden! At WagesbyNet we get it right and do the hard work for you, by dealing with all (as much as you’d like us too) aspects of your UK Payroll Services.

Hassle free with a Peace of mind

Our confidential approach and password protected reports and payslips ensure that security is guaranteed, providing you with total peace of mind. However complex your salaries may be, your staff will be paid accurately, on time, every time as we do the hard work for you!

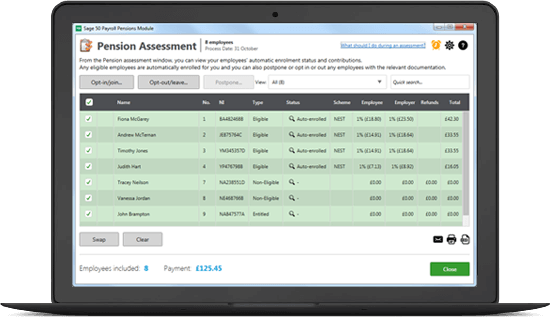

Sage Payroll Software is used in our bureau which provides us with the latest technology, legislation and online submission credentials to make sure we are always ahead of the game! Fully compliant with RTI (Real Time Information) & Pension Auto Enrolment so we can also submit your Pension Contribution files for you.

The WBN Payroll Service includes

- Submitting the required fully RTI Compliant Reports to HMRC.

- Password Secured Email Payslips directly your employees (Adobe PDF) or with Sage Online Payslips*.

- Running the Pension Assessment using the Sage Payroll Pension Module if required*.

- E-Delivering Standard Analysis Reports for information and entry on to accounting systems*.

- Providing you with the total liabilities of PAYE & NIC due to HMRC.

- Processing new employees and leavers.

- Processing SSP, SMP, Tax Credits, AOE Orders, Student Loans, Pensions and any other payments or deductions.

- Creating employer and employee records including any non standard additions and deductions.

- Creating P60 forms for all employed during the tax year and Submission of tax year figures to HMRC

The WBN Payroll Bureau

Our Payroll Reports are E-Delivered and Password Protected or with Sage Online Services. We use the Sage Payroll Pension Module* to make sure nothing get missed when it comes to auto enrolment.

Using the Cashbacs Submission System* we can also pay employees directly into their bank accounts by BACS. This system does not require you to lift a finger!

*An additional fee may be required for these Services.

Our Payroll Services

When signing up to WagesbyNet Payroll Services you will be required to pay our Monthly & Annual Year End fees by Direct Debit. We use GoCardless for our Direct Debits which integrates directly into our Sage 50cloud Accounts software and provides you with all the same Direct Debit Guarantees that you get when dealing with your Electric or Communications supplier.

For more information or a copy of our Payroll Bureau Tariff for the current Tax Year please contact us here.

Paying your employees

CashBacs allows you to enjoy all the benefits of using BACS Direct Credit to make payments to employees accounts by electronic transfer.

We can create a BACS payment file that you can upload to the CashBacs online portal and if required, we can also deal with uploading it on your behalf.

Cashbacs Pay Staff & Suppliers

Enjoy all the benefits of using BACS Direct Credit to make payments into a bank or building society account by electronic transfer. Get all the backup of a BACS approved bureau taking care of your payments, so you can control your payments with confidence.

- A cloud-based system that’s easy to use.

- No need to buy, install or maintain BACS software.

- Access your payments at any time and anywhere.

- Accepts files from all major finance software.

- Meets HMRC RTI requirements for payroll.

- With a call, get support from 8.30am to 7pm on all English banking days.